Transfer money and pay bills

Convenient and secure

Between accounts or between friendssend your money with confidence.

Download our appMoney where you need itwhen you want it

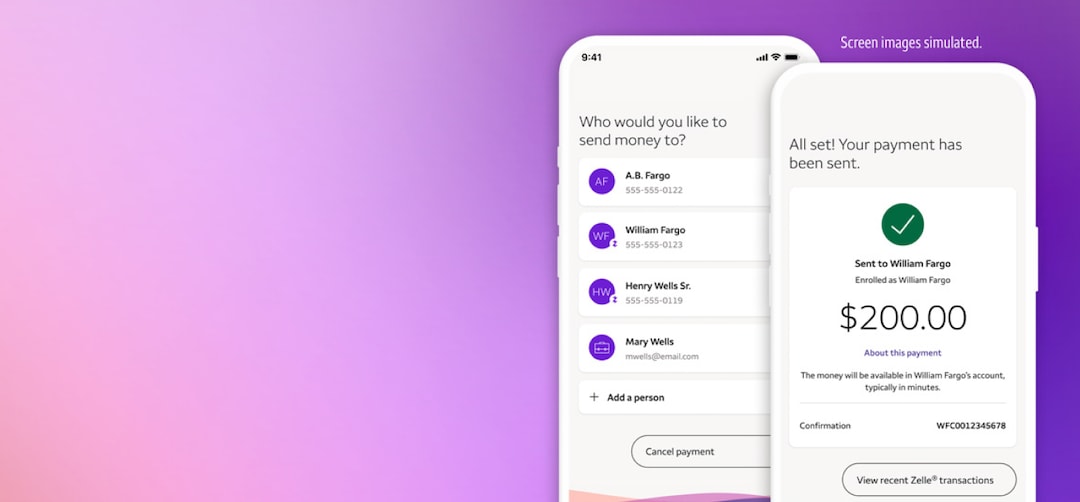

Use Zelle® to send and request money

- Safely and easily send and receive money with trusted friends and family who have U.S. bank accounts

- Send money fast — within minutes

Transfer money between accounts

- Move money between Wells Fargo accounts

- Transfer funds to and from other U.S. financial institutions

Pay your bills online

- Use Bill Pay for sending payments within the U.S.

- Set up a one-time payment or schedule recurring payments

Use your digital wallet

- Use your mobile device to make quicksecure payments on the go

- Access Wells Fargo ATMs with your digital wallet — no card needed

Securely wire money to businesses and individuals

- Use digital wire transfers to send money within the U.S. and abroad

- Send funds in foreign currencies or U.S. dollars

Send money to friends and family abroad

- Use ExpressSend® to send money to people in 12 countries

- Transfer money for cash pick-up or for credit to an account

Simplify the way you pay and get paid

With the Wells Fargo Mobile® app:

- Securely send and receive money with Zelle®

- Easily tell Fargo® to send money to your stored contacts

Mobile and online banking when you need them

Manage your money on the Wells Fargo Mobile® app when you’re on the go. And use Wells Fargo Online® when it’s more convenient to be on your computer.

How was your experience? Give us feedback.

Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Terms and conditions apply. To send or receive money with Zelle®, both parties must have an eligible checking or savings account enrolled with Zelle® through their bank. Transactions between enrolled users typically occur in minutes. For your protectionZelle® should only be used for sending money to friendsfamilyor others you trust. Neither Wells Fargo nor Zelle® offers purchase protection for payments made with Zelle® - for exampleif you do not receive the item you paid for or the item is not as described or as you expected. Payment requests to persons not already enrolled with Zelle® must be sent to an email address. For more informationview the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. Your mobile carrier’s message and data rates may apply. Account fees (e.g.monthly serviceoverdraftSmall Business Account Analysis fees) may apply to Wells Fargo account(s) with which you use Zelle®.

Terms and conditions apply. Setup is required for transfers to other U.S. financial institutionsand verification may take 1–3 business days. Customers should refer to their other U.S. financial institutions for information about any potential fees charged by those institutions. Mobile carrier’s message and data rates may apply. See Wells Fargo’s Online Access Agreement for more information.

Digital wallet access is available at Wells Fargo ATMs and participating non-Wells Fargo ATMs for Wells Fargo Debit Cards in digital wallets. Message and data rates may apply. Some ATMs within secure locations may require a physical card for entry.

Digital wallets may not be available on all devices. Your mobile carrier's message and data rates may apply.

In addition to any applicable feesWells Fargo makes money when we convert one currency to another currency for you. The exchange rate used is set by Wells Fargoincludes a markup and may be different than exchange rates you see elsewhere. For additional information related to Wires and foreign currency wiresplease see the Online Access Agreement or applicable service documentation.

Enrollment in Digital Wires is subject to eligibility requirementsand terms and conditions apply. Applicable outgoing or incoming wire transfer service fees applyunless waived by the terms of your account. Your mobile carrier's message and data rates may apply. For more informationsee the Wells Fargo Online Access Agreement and your applicable account fee disclosures for other termsconditionsand limitations.

The first remittance sent under each service agreement must be completed in person at a Wells Fargo branch. Customers with an existing checking or savings account may be able to complete their first remittance by calling the Wells Fargo Phone Banksubject to caller authentication requirements and additional fraud prevention controls. Additional remittances may be completed at a Wells Fargo branchby calling the Wells Fargo Phone Bankor through Wells Fargo Online® at wellsfargo.com. ExpressSend is not available on the Wells Fargo Mobile® app. Customers must use a desktop or laptop to conduct online ExpressSend transfers.

Due to unanticipated conditions such as natural disasterscivil disturbancessystem issuescurrency availabilitylocal regulatory requirementsrequired receiver action(s)and/or location-specific security concernscash pick-up remittances may not be available in certain Remittance Network Members (RNMs) and/or cities. If your beneficiary experiences any issues with the cash pick-upcontact us at 1-800-556-0605.

The credit to account or the cash pick-up delivery methods for remittances may not be available at all Remittance Network Members or locations. When sending money to an accountwe will need the beneficiary’s qualifying deposit account number at the Remittance Network Member. When sending money for cash pick upthe beneficiary's name provided by the sender must exactly match the beneficiary's name on their government issued identification.

Availability may be affected by your mobile carrier’s coverage area. Your mobile carrier’s message and data rates may apply. Fargo is only available on the smartphone versions of the Wells Fargo Mobile® app.

Screen images are simulated. Featuresfunctionalityand specifications appearing in those images may change without notice.

Zelle® and the Zelle® related marks are wholly owned by Early Warning ServicesLLC and are used herein under license.

Wells Fargo BankN.A. Member FDIC.

QSR-09192026-7764149.1.1

LRC-0325